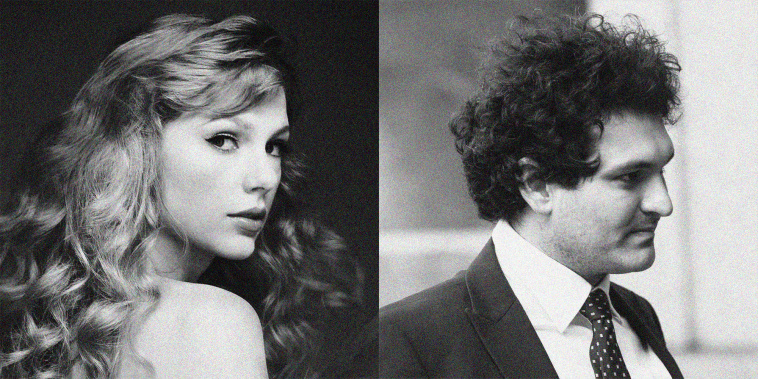

Taylor Swift signed and agreed to a sponsorship deal with bankrupt crypto exchange FTX after months of discussion before executives at FTX decided not to go through with the deal, a person familiar with the matter told CNBC.

The nature of the agreement, previously reported by The New York Times on Thursday, contradicts public messaging about the nature of the failed FTX-Swift deal. Public statements by a class-action attorney lauded Swift’s due diligence efforts and said that the artist asked the exchange to explain why its listed assets were not considered unregistered securities.

But Swift did ultimately agree to the deal, the person familiar with the matter told CNBC. The signed agreement was sent to FTX founder Sam Bankman-Fried’s email inbox, where it remained unanswered for a period of a few weeks, the person told CNBC, adding that ultimately, a group of FTX executives persuaded Bankman-Fried not to follow through with the reported $100 million deal.

Three other sources familiar with the matter told The New York Times that Swift’s team signed the deal with FTX after six months of negotiations, and that Bankman-Fried ultimately pulled the plug.

The person familiar with the matter asked to be kept anonymous due to ongoing federal and bankruptcy proceedings. The existence of an FTX-Swift partnership was first reported by The Financial Times.

A person familiar with the negotiations and who requested anonymity because they were not authorized to speak said FTX wanted Swift to endorse them by doing commercials, interviews and promotional events on their behalf, like other celebrities were doing at that time — but she would not agree to endorse FTX. Negotiations were narrowed down to a tour sponsorship deal. That’s why the deal was never finalized, the source said.

FTX filed for bankruptcy protection in November 2022. Bankman-Fried faces multiple federal charges, including fraud and campaign finance violations. Three other FTX executives — Gary Wang, Caroline Ellison and Nishad Singh — have pleaded guilty to various federal charges and are cooperating with the government’s prosecution of Bankman-Fried.