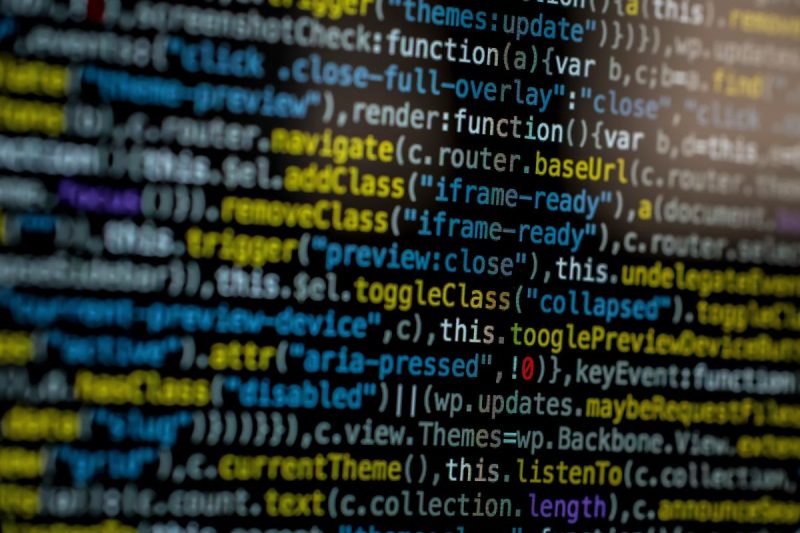

CrowdStrike Holdings (NASDAQ:CRWD) has identified a system update as the cause of widespread global computer outages that have affected diverse businesses, including airlines, hospitals and banks.

Initial concerns over a potential hack were dismissed, with the cybersecurity company explaining on Friday (July 19) that the issue was not related to any security incident or cyberattack.

The outages were caused by a defect in a single content update for Windows hosts, specifically linked to Falcon Sensor software. This defect led to numerous systems encountering the notorious ‘blue screen of death.’

Mac and Linux hosts were not affected by this issue.

CrowdStrike and Microsoft (NASDAQ:MSFT) have both issued statements addressing the situation.

A Microsoft spokesperson acknowledged the issue, stating, “We’re aware of an issue affecting Windows devices due to an update from a third-party software platform. We anticipate a resolution is forthcoming.”

Meanwhile, CrowdStrike shared more detailed information on the problem and the steps taken to resolve it, providing manual workarounds for individual hosts and public clouds in its most recent statement.

The impact of the outage has been significant, with major industries such as banking, air travel and healthcare experiencing disruptions. The defect caused critical systems to crash, leading to delays and operational challenges.

In the banking sector, some ATMs and online banking services were temporarily unavailable.

Airlines faced delays and cancelations as their computer systems went offline, while hospitals reported issues with electronic health records and patient management systems. More than 3,300 flights have been canceled worldwide, accounting for about 3 percent of all scheduled services, though not all cancelations may be due to the IT outage.

Following the outage, CrowdStrike shares were down nearly 15 percent on the Nasdaq in New York as the market opened, erasing an equivalent of US$12.5 billion in market value.

As businesses continue to recover from the outage, CrowdStrike said it is focused on providing customer support and deploying a fix; it also said systems brought online after the identified issue will not be affected.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.