G Mining Ventures (TSX:GMIN,OTC Pink:GMINF) announced on Tuesday (September 3) that it has started commercial production at its Brazil-based Tocantinzinho gold mine both on time and on budget.

Tocantinzinho, which has been under development since September 2022, is now operational, and is expected to produce an average of 174,700 ounces of gold annually over its 10.5 year lifespan.

For the first five years of production, average yearly gold output will be higher at 196,200 ounces.

Tocantinzinho’s transition to commercial production was confirmed after the mill operated at 76 percent of its nameplate throughput capacity for 30 consecutive days in August. During this period, the mine processed over 300,000 metric tons of ore at a recovery rate of 88 percent, meeting the criteria set for commercial production.

The company is now ramping up operations, and is aiming to achieve full nameplate throughput by Q1 2025.

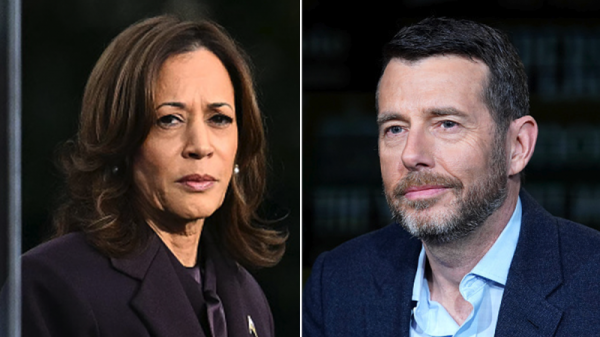

Louis-Pierre Gignac, CEO of G Mining Ventures, expressed satisfaction with the progress seen so far at Tocantinzinho, highlighting the efforts of the team involved in bringing the mine to this stage.

“This achievement is the culmination of 5.8 million person-hours focused on building, testing and ramping up production at Brazil’s newest major gold mine,” he said in the company’s press release. “With this accomplishment behind us, we remain committed to enhancing plant performance and achieving our production and cost KPIs.’

The construction and commissioning phases were completed with a focus on safety and efficiency, allowing work at the asset to remain within the projected timeline since construction began in H2 2022.

G Mining Ventures intends for Tocantinzinho to be a cornerstone asset, and sees it benefiting from today’s high gold price. The company will provide annual guidance for the operation in January 2025.

The ramp-up phase, which will continue through the second half of 2024, will be key for optimizing plant operations and achieving the projected recovery rate of 90 recent over the life of the mine.

G Mining Ventures’ future milestones include the release of a preliminary economic assessment for its Oko West project in Guyana; exploration results are also pending from Oko West as well as Tocantinzinho.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.