Macy’s on Thursday said it will cut about 3.5% of its workforce and close five of its namesake mall locations as the legacy department store moves to trim costs and turn around slowing sales.

The move will affect approximately 2,350 positions across its corporate office and stores, company spokesman Chris Grams said.

“As we prepare to deploy a new strategy to meet the needs of an everchanging consumer and marketplace, we made the difficult decision to reduce our workforce by 3.5% to become a more streamlined company,” the company said in a statement.

The company notified employees about the layoffs on Thursday and the last day for affected employees will be Jan. 26.

Stores that will be shuttered are located in Arlington, Virginia; San Leandro, California; Lihue, Hawaii; Simi Valley, California and Tallahassee, Florida. The stores will close in early 2024, Grams added.

Macy’s is the middle of an effort to turn the roughly 166-year-old department store into a brand that resonates with consumers who are shopping online; looking for value; and turning to competitors including e-commerce retailers such as Amazon and Shein, big-box players such as Target and off-price names such as TJX-owned T.J. Maxx instead of its stores.

As part of that push, Macy’s is overhauling its private-label brands; opening smaller shops outside of the mall; and looking to its beauty chain, Bluemercury, and higher-end department store, Bloomingdale’s, to drive growth.

In the fall, the company said it would open up to 30 smaller stores in strip malls over the next two years. Macy’s has been better known for giant mall stores, but the company is trying to chase consumers in the suburbs who are going to outdoor shopping centers a short drive away for groceries or a new outfit.

Macy’s, the parent company that includes its namesake brand, Bloomingdale’s and Bluemercury, will also get a new leader soon. Tony Spring, CEO of Bloomingdale’s, will step into the CEO role for Macy’s in early February as outgoing CEO Jeff Gennette retires.

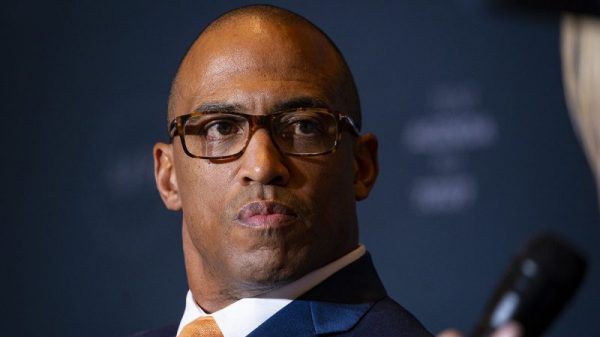

On the company’s earnings call in October, Chief Financial Officer and Chief Operating Officer Adrian Mitchell hinted that Macy’s would take another hard look at its stores. He said the company had to “deliver relevant products, strong value and a more enjoyable shopping experience,” and some of that would include “optimizing our physical footprint.”

“We are committed to bringing more inspiration on a daily basis to our customers,” he said. “We look forward to sharing more on how that ladders to long-term profitable growth on our fourth quarter call.”

Mitchell also told investors on the call that Macy’s “anticipated closure of less than 10 locations in early 2024.”

Yet, Macy’s sales and stock performance have lagged. The company has not yet reported its holiday quarter, but said in October that it expected same-store sales to decline up to 7% for its fiscal 2023. It’s expected to report fiscal fourth-quarter earnings in late February.

Shares of the company closed Thursday at $17.93, down nearly 11% so far this year. That compares to the roughly flat performance of the S&P 500 during the same period.

Macy’s has 723 locations across the country, as of Oct. 28, the end of the most recently reported quarter. The majority of those — roughly 500 — are its namesake stores, followed by 158 Bluemercury stores and 56 Bloomingdale’s stores.

The department store chain’s footprint has gotten smaller in recent years, however. About four years ago, Macy’s announced another major layoff and wave of store closures. It made the announcement in February 2020, just weeks before the Covid-19 pandemic led to lockdowns and the temporary shuttering of many malls and retail stores across the country.

At the time, Macy’s said it would shut 125 stores over the following three years and slash about 2,000 corporate jobs, as it closed its Cincinnati headquarters and tech offices in San Francisco.

The company is reconsidering its store count again.

In March 2023, Gennette said the company was “evaluating the right number and mix of on- and off-mall locations,” and added that the customer and retail backdrop had changed since the February 2020 announcement. He said since that 2020 announcement, Macy’s had closed about 80 namesake locations and had plans to soon close another five.

“We have shuttered our most significant underperformers, exited dying centers and improved the existing store experience, while delaying closures of others that are cash flow positive,” he said on the March call. “Today, roughly 99% of our mall base is profitable on a four-wall basis.”

The news on Thursday was first reported by The Wall Street Journal.