Federal student loan borrowers are confronting some challenges in restarting their payments since a pandemic-era pause ended in October.

The Consumer Financial Protection Bureau said Friday that borrowers are dealing with inaccurate and untimely billing statements and delays in processing, among other issues.

“Borrowers are encountering long hold times when trying to reach their student loan servicer, experiencing significant delays in application processing times for income-driven repayment plans, and receiving inaccurate billing statements and disclosures,” the federal agency said.

The CFPB released the “issue spotlight” as part of its oversight of student loan practices since payments were restarted in October for more than 22 million borrowers.

Federal student loan borrowers had a reprieve in payments for more than three years as a pandemic-era repayment pause was extended multiple times since it instated in March 2020.

More than 45 million borrowers collectively owe approximately $1.6 trillion, according to the Biden administration, which tried to cancel up to $20,000 in student debt for tens of millions of eligible borrowers. The Supreme Court killed the program in June.

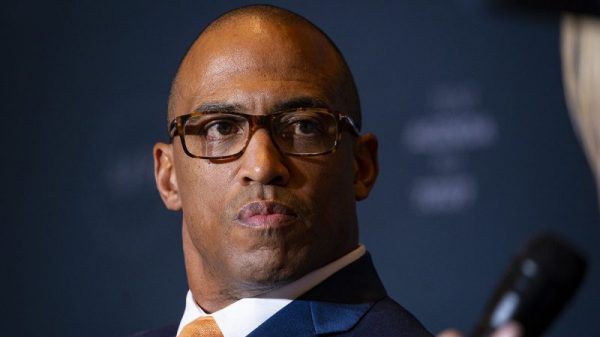

“The resumption of student loan payments means that borrowers are making billions of dollars of payments each month,” Rohit Chopra, the bureau’s director said in the statement. “If student loan companies are cutting corners or sidestepping the law, this can pose serious risks to individuals and the economy.”

One of the “key concerns” identified by the agency was long hold times and abandoned phone calls.

The report found that borrowers were frequently forced to wait on hold for more than an hour with their loan servicers and many of them gave up without receiving assistance.

“Many servicers were able to boost their financial performance by dramatically reducing staffing during the pandemic. However, servicers have not met the foreseeable borrower demand for help with their loans,” the agency said.

Federal student loan borrowers have been receiving “faulty and confusing bills” from servicers, including errors such as premature due dates and inflated monthly amounts due to outdated poverty guidelines, the agency said.

The bureau also found there were significant delays in the processing of repayment plan applications. The agency found that millions of income-driven repayment plan applications were submitted between August and October and that, as of late October, servicers reported more than 1.25 million pending applications, with more than 450,000 applications pending for more than 30 days. Some servicers have taken five times longer than others to process applications, the bureau said.

On Friday, the Education Department said it was withholding payments from three student loan service providers as part of its “continued efforts to strengthen protections for student loan borrowers and hold servicers accountable.”

The administration found that Aidvantage, EdFinancial and Nelnet “all failed to meet contractual obligations” to send timely billing statements to 758,000 borrowers.

Because of those errors, the department said it was withholding payment of $2 million from Aidvantage, $161,000 from EdFinancial and $13,000 from Nelnet. The department said it directed the servicers to place affected borrowers into forbearance until the issues were resolved.

“Today’s actions make clear that the Biden-Harris Administration will not give student loan servicers a free pass for poor performance and missteps that jeopardize borrowers,” Secretary of Education Miguel Cardona said in a statement.

“As millions of Americans return to repayment, the Department of Education will continue to engage in aggressive oversight of student loan servicers and put the interests of borrowers first. When unacceptable errors are uncovered, servicers should expect to be held accountable and borrowers should count on this administration to hold them harmless.”

Nelnet said in a statement to NBC News that fewer than .04% of its 14.5 million borrowers had missing or late statements, “including some borrowers who moved their own due date up to better meet their situation.”

‘While we are confident the number of borrowers with Nelnet-caused billing statement errors is less than the number released we do take seriously our responsibility to borrowers and regret any mistakes made during the extraordinary circumstances of return to repayment,” the loan servicer said.

EdFinancial declined to give a statement and instead referred to the Education Department for questions regarding its announcement.

Eileen Cassidy Rivera, a spokesperson for Maximus, the company that oversees Aidvantage, said in a statement that “Our goal in service to the Department of Education and nearly nine million borrowers is to provide excellent service that respects and protects the rights of borrowers.”

“Upon our identification of this issue, we took immediate action to rectify the error and prevent any risk of future occurrence,” Rivera said. “We take all our contractual obligations seriously and are transparent and accountable for our performance.”

In October, the Education Department withheld $7.2 million in payment from the Missouri Higher Education Loan Authority, known as MOHELA “for its failure to send timely billing statements to 2.5 million borrowers.” At the time, the department also directed MOHELA to place affected borrowers into forbearance until the issue was resolved.