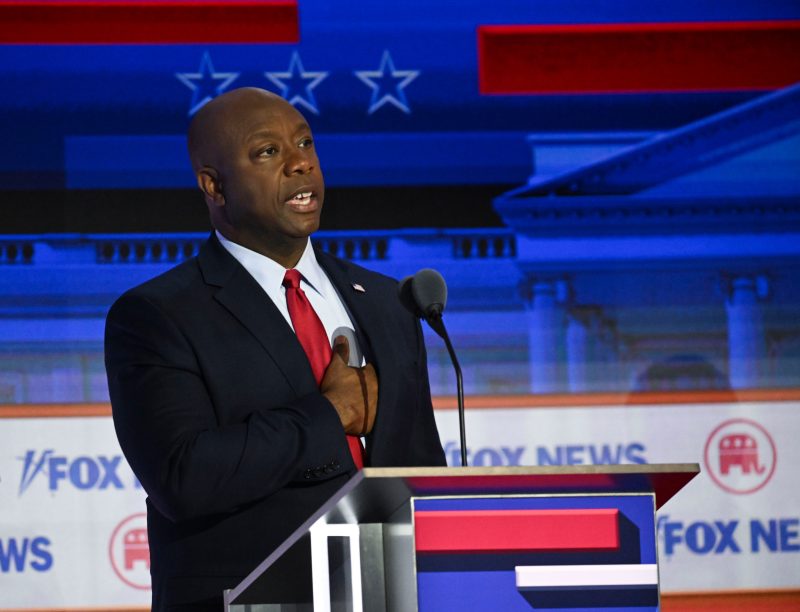

A super PAC supporting Sen. Tim Scott’s White House bid told donors that it plans to cut fall ad buys, a sign of the stagnation in the 2024 GOP race as Donald Trump maintains a dominant lead less than 100 days before the Iowa caucuses.

In a memo to donors, Rob Collins, co-chair of the Trust in the Mission PAC, wrote: “We aren’t going to waste our money when the electorate isn’t focused or ready for a Trump alternative. We have done the research. We have studied the focus groups. We have been following Tim on the trail. This electorate is locked up and money spent on mass media isn’t going to change minds until we get a lot closer to voting.’

Collins added that the super PAC will continue to “fully fund our grassroots door knocking, conduit fundraising, event hosting, and earned media efforts.’

The dramatic move to pull back on ad spending is an acknowledgment of the South Carolina Republican’s struggle to build a viable base of support in the race. Scott, the only Black Republican in the Senate, is running on a message of hope and optimism as well as his life story.

But despite his cash advantage over rivals to Trump — entering the race with $22 million from his Senate campaign — and the millions he has spent on ads, the senator has yet to break through.

For months, Trump has remained the dominant polling leader, with Florida Gov. Ron DeSantis polling in a distant second. The memo acknowledged that while the super PAC prepared for the field to narrow, that dynamic has not materialized.

Earlier this summer, the super PAC announced that it would reserve $40 million in television and digital ads in Iowa, New Hampshire and South Carolina.

Scott, who officially launched his campaign in May after forming an exploratory committee, is registering at 3 percent in a Washington Post average of September and October polling. In May 2023, he was averaging at 2 percent. A mid-September CBS News/YouGov poll showed Scott polling at 6 percent in Iowa and 5 percent in New Hampshire, among likely GOP voters.

Scott’s campaign showed an astonishingly high burn rate in the third quarter — spending nearly three times as much as he raised over the past three months. His official campaign and the allied super PAC have been among the biggest spenders in the 2024 race on television ads.

A campaign aide defended the early spending on ads that far surpassed what the campaign was bringing in, as Scott was seeking to establish national name recognition.

But Scott’s struggle to keep pace with other contenders clearly took a toll on his fundraising. He raised just $4.6 million in the period covering July, August and September, but spent $12.4 million.

He is still better-positioned than many of his GOP rivals to stay in the race, however, because he had transferred so much money over from his Senate campaign account when he entered the race. At the beginning of October, he had about $13.3 million in cash left in his campaign account.

It is unclear how much money Trust in the Mission PAC has in its accounts, because that committee will not have to file its next set of disclosures to the Federal Election Commission until Jan. 31. Unlike campaigns, super PACS are not constrained by contribution limits from individuals, often enabling them to raise more money from wealthy donors.

One person familiar with the PAC’s strategy but granted anonymity to speak about internal discussions, said the data shows that the ad dollars spent thus far aren’t moving voters so it made sense to shift strategy and redirect some of those dollars into supporting the candidate’s effort on the ground in states such as Iowa.

When reserving the ad time initially, advisers had hoped that Scott might have had a “break out” moment by now and that the PAC would need to be positioned to combat a negative onslaught from Trump or DeSantis this fall. But neither of those things materialized. That person suggested that the memo should not be interpreted as a signal for the South Carolina Republican to pull out of the race.

The memo also took a shot at Scott’s fellow South Carolinian, former U.N. ambassador Nikki Haley, who has seen an upward trajectory in the race.

“Earlier this year, the anyone-but-Trump experts told the Party that Gov. DeSantis was going to defeat Trump, and good Republicans should clear the field,” Collins wrote. “Now those same experts are calling for the field to be cleared for Gov. Haley. We also reject this advice. Campaigns have seen the polling. They have spoken to the grassroots. No serious person thinks a moderate will win this primary no matter how many elite insiders champion their candidacies.”

The memo argued that most Iowa caucus-goers will make their final decisions later and said that the super PAC will focus on hosting more events and expanding its field program. Both the super PAC and the campaign have highlighted Scott’s favorability numbers as well as his conservative credentials, while attempting to characterize Haley as a moderate, a characterization her advisers reject.

Collins also indicated that Scott’s supporters are hoping to build momentum heading into the South Carolina primary. A September Fox Business poll had Scott polling at 9 percent in the Palmetto State, among GOP primary voters. The September CBS News/YouGov poll found that 55 percent of likely Iowa GOP caucus voters viewed Scott as likable, while 50 percent of likely New Hampshire GOP primary voters viewed him as likable.

“In a news environment dominated by two wars and a chaotic scrum over the Speakership, TV money will simply be wasted,” the memo said. ‘Voters are tuning out a political race where no one will caucus for more than three months. When they do plug in, Republican voters simply will not accept a Trump alternative hoisted upon them by the same pundits and insiders who tried — unsuccessfully — to thwart a Trump nomination in 2016. ‘

Emily Guskin and Meryl Kornfield contributed to this report.