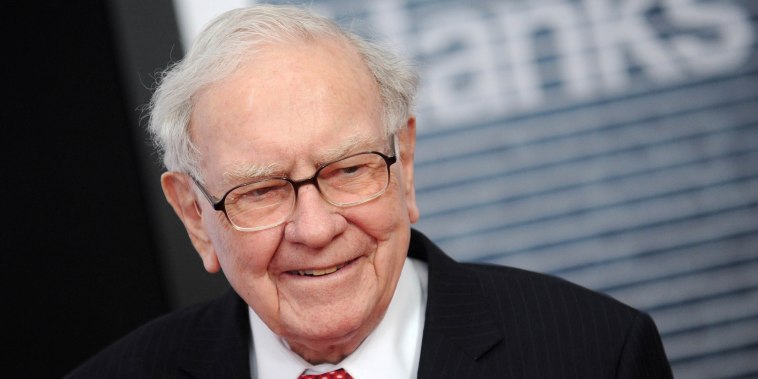

Warren Buffett on Friday made his biggest annual donation to date, giving $5.3 billion worth of Berkshire Hathaway shares to five charities.

The legendary investor, who’s turning 94 in August, converted 8,674 of his Berkshire Class A shares to donate more than 13 million Class B shares, according to a statement Friday. A total of 9.93 million shares went to the Bill & Melinda Gates Foundation, with the rest going to the Susan Thompson Buffett Foundation, named for his late first wife, and the three charities led by his children Howard, Susan and Peter Buffett.

The “Oracle of Omaha” has pledged to give away the fortune he built at Berkshire, the Omaha, Nebraska-based conglomerate he started running in 1965. Buffett has been making annual donations to the five charities since 2006.

After Friday’s donations, Buffett owns 207,963 Berkshire A shares and 2,586 B shares, worth about $130 billion.

In an interview with The Wall Street Journal, Buffett clarified that after his death, the enormous fortune he amassed from building the one-of-a-kind conglomerate will be directed to a new charitable trust overseen by his three children.

“It should be used to help the people that haven’t been as lucky as we have been,” he told the Journal. “There’s eight billion people in the world, and me and my kids, we’ve been in the luckiest 100th of 1% or something. There’s lots of ways to help people.”

Buffett has previously said his three children are the executors of his will as well as the named trustees of the charitable trust that will receive 99%-plus of his wealth.

He told the Journal that the Bill & Melinda Gates Foundation will no longer receive donations after his death. Buffett resigned as a trustee at the Gates Foundation in June 2021 in the midst of Bill and Melinda Gates’ divorce.

At Berkshire’s annual meeting in May, Buffett spoke candidly to shareholders about a future when he’s no longer at the helm, appearing solemn at times as he pondered his advanced age and reflected on his late friend and business partner Charlie Munger.

Greg Abel, vice chairman for noninsurance operations at Berkshire, has been named Buffett’s successor and has taken on most of the responsibility at the conglomerate.

Buffett previously said his will will be made public after his death.

“After my death, the disposition of my assets will be an open book — no ‘imaginative’ trusts or foreign entities to avoid public scrutiny but rather a simple will available for inspection at the Douglas County Courthouse,” Buffett said in November.