What is a void check?

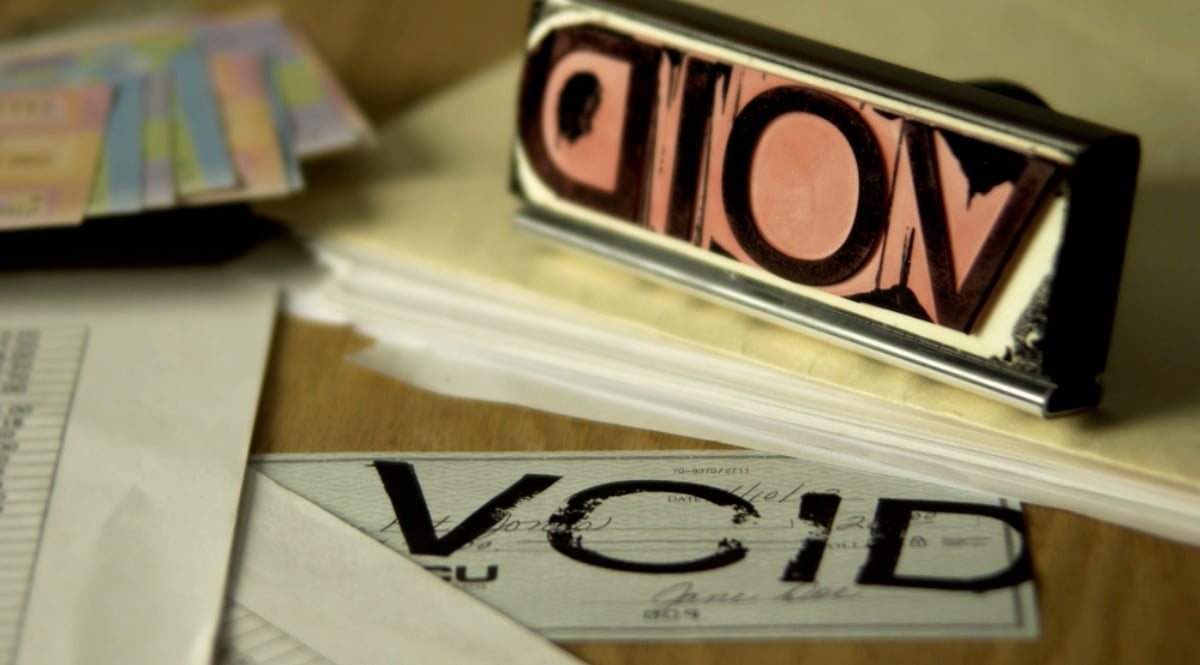

A voided check has the word “VOID” written across it, indicating that it cannot be used for payment.

Voiding a check ensures it won’t be used by anyone, such as thieves who may write in a large amount for themselves. Then, it can provide key information like your routing number and account number to be used in electronic transactions.

You may need to void a check when you make an electronic financial transaction. A voided check includes banking information required to ensure correct electronic banking transactions for people who pay bills online and or are paid via direct deposit.

Voided check explained

A voided check is a blank check from your checking account with the word “VOID” written across the front in large letters, typically in blue or black ink. Writing “VOID” on a check makes it unusable for electronic payments or cashing.

However, the check still displays your banking information, including bank account number and check number, which is useful when setting up direct deposit or automatic payments.

The details on the voided check, such as the bank account number and routing number at the bottom of the check, help in setting up electronic links to your account for services like online banking, direct deposit of salaries, or automatic bill payments from credit cards. The signature line remains empty, ensuring the check’s invalidity for transactions.

When to use void check?

A voided check serves a specific purpose: it securely provides your banking information for legitimate financial setups without risk.

Since a voided check cannot be used for transactions, it’s a safe way to share account details. You might use a voided check to set up direct deposits of salaries or government benefits, authorize automatic loan payments, or establish automated bill payments.

By using a voided check, you avoid the risk of errors in copying account information and protect against fraud and identity theft. It’s a practical solution when you need to give your banking information for setting up electronic transactions.

How do you void a check depending on situation

Are you looking for how to void a check? Let’s first see what situations can justify it:

prevent the caching of an issued check;

cancel a cashier’s check;

A canceled check is requested as part of the subscription to a contract (telephone plan, for example).

Note: in the event of a lost, stolen or fraudulently used check, we do not speak of check void but of stop payment.

Here’s how to cancel a check.

Case 1: Prevent the cashing of a check

You have issued a check and you wish to prevent its cashing. Be careful, the cases allowing you to do this are exhaustively listed.

Indeed, the simple fact of being in dispute with the merchant or person does not allow you to cancel the check that you issued to them.

The procedure is reserved for cases exhaustively listed in the monetary and financial code, which are:

loss of check;

check theft;

a safeguard, recovery or liquidation procedure for the professional beneficiary of the check.

You can find out if the professional is in a safeguard, recovery or liquidation procedure by contacting the commercial court at the company’s headquarters business ;

fraudulent use of checks: imitation of signature, modification of the amount, etc.

Case 2: Cancel a cashier’s check

A cashier’s check is a check whose amount has been withdrawn from your account by your bank before it is issued. It therefore guarantees payment to its recipient.

The transaction for which you requested the issuance of a bank check has not been completed: you must now cancel the bank check to obtain reimbursement of the amounts taken from your account by the bank.

Go to your bank counter.

Return the crossed cashier’s check, writing “void” on it.

The bank will recredit the amounts to your account, without reimbursing you for the costs generated by issuing the bank check.

As you can see, it is easy to cancel a cashier’s check, so be careful when you receive one. Do not hesitate to check with the issuing bank the validity of the check and cash it quickly.

Case 3: Submit a cancelled check

When signing up for a contract, you may be asked for a void check. Simply cross the check and note “voided” on the check, without signing it. This crossed check can serve as a bank identity statement. Your co-contractor checks that you are not prohibited from banking.

Void check alternatives

If you need an alternative to a voided check for setting up automatic payments or direct deposits, but lack paper checks or prefer not to use one, several options exist. You can use a direct deposit authorization form, ensuring accurate bank details.

Alternatively, a voided counter check, a blank check available at bank branches, can work. Another option is using a preprinted deposit slip, often found with your checkbook. Lastly, a photocopy of a check or deposit slip might suffice. The suitability of these options varies based on what your bank offers and the requirements of the recipient.

In Conclusion

Voided checks play a crucial role in secure banking transactions. They offer a safe way to provide banking details for setting up electronic payments, like direct deposits and automatic bill payments.

Writing “VOID” across the check prevents misuse, ensuring your account information is shared safely for legitimate purposes only.

For those without paper checks or preferring not to void one, alternatives like direct deposit forms, voided counter checks, deposit slips, or photocopies can also serve the same purpose.

These methods help avoid errors and protect against fraud, making voided checks a practical solution in modern banking.

The post What is a void check? appeared first on FinanceBrokerage.